PropNex Picks

|December 04,20255 Most Expensive HDB Estates (Based on Average Resale PSF)

Share this article:

If you've scrolled through property listings lately and felt personally attacked by HDB resale prices, you're not alone. In 2024, resale flat prices climbed 9.6%, almost doubling the 4.9% increase from the previous year.

And even though price growth has slowed considerably in 2025, rising just 2.9% in the first three quarters, that doesn't mean things suddenly got affordable. What we're seeing is a market that's stabilising on the surface, while certain towns continue to break records.

Because the price growth may not be equal across all towns, some estates have pulled ahead, with resale flats now commanding premiums that can rival private homes. So here's a look at which estates sit at the top and what's driving their rise.

Source: hdb.gov.sg

Average resale price (Nov 2024 - Oct 2025): $862,779

Average psf (Nov 2024 - Oct 2025): $956

The Central Area, or better known as the Central Business District (CBD), is where Singapore's heartbeat lies. Home to districts like Marina South, Orchard, Outram, and River Valley, it's one of the country's most dynamic and densely built-up regions.

While high-rise offices and luxury condos dominate the skyline, a small pocket of HDB housing exists quietly among them. Most of these flats are in Rochor and Outram, including mixed residential and commercial developments that give residents the rare privilege of living right in the city centre.

As of March 2025, HDB managed just 8,880 flats here, housing around 24,990 residents. This makes the central area one of the smallest yet most exclusive public housing zones in Singapore. Take the Pinnacle@Duxton as an example. It's arguably one of the most iconic HDB projects out there. The 50-storey development not only redefined what public housing could look like, but also set a new standard for city living with its sweeping sky bridges and panoramic skyline views.

So it's no surprise that Central Area flats have become a class of their own. In fact, 64 out of 175 resale transactions in the past year crossed the million-dollar mark, with many even pushing past $1.5 million.

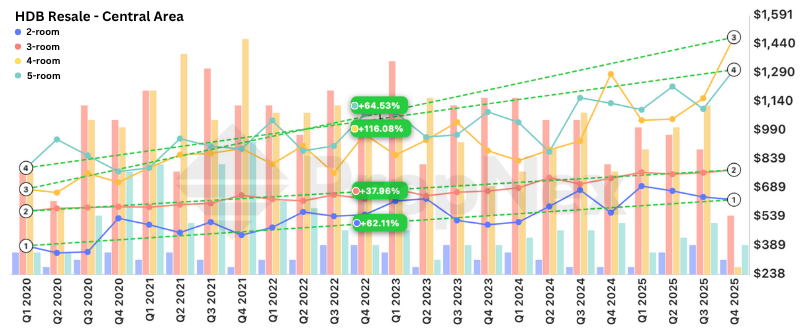

On top of that, HDB resale prices in the Central Area have grown across all flat types since 2020. 4-room flats are in the lead, more than doubling in value with a 116% jump. 5- and 3-room flats are neck and neck, with a 64% and 62% growth respectively. Whereas 2-room units gained around 38%.

Source: PropNex Investment Suite

The consistent upward trajectory reflects how scarcity and prestige fuel demand here, especially considering there are only a handful of HDB projects within the Central Area. And yet they sit alongside luxury condos and major business districts.

Source: hdb.gov.sg

Average resale price (Nov 2024 - Oct 2025): $759,985

Average psf (Nov 2024 - Oct 2025): $853

Named after Queen Elizabeth II's coronation in 1952, Queenstown was Singapore's very first satellite town. It was first planned by the Singapore Improvement Trust (SIT) in the 1950s before HDB took over in the 1960s. As of March 2025, it is home to around 77,340 HDB residents across 30,511 flats.

Queenstown may be the oldest HDB town out there, but it is by no means outdated. In fact, it was one of the earliest estates designed to be self-sufficient, with its very own town centre and sports complex. But it didn't stop there.

Right now, Queenstown is also pioneering a vision for wellness-living. With its very own Health District, the town is being redeveloped with amenities that support physical, social, and mental well-being, especially for seniors. And if this Health District pilot is successful, its wellness and care innovations can be scaled to other towns in the future.

This development could potentially increase demand over time, especially from families with children, seniors, and other health-centric individuals. And since Queenstown also has good connectivity and proximity to the city centre, it's no wonder the town made it high up on the list. It even holds the record for highest resale HDB price at $1.66 million!

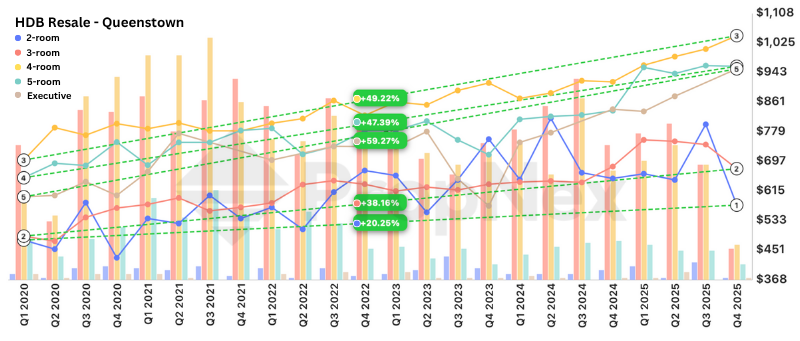

And 155 more homes crossed the million-dollar mark, out of 601 resale transactions in the past year. Prices here have also climbed steadily since 2020. Executive flats lead the growth at 59%, thanks to its exclusivity. Following that are 4-room units at 49% and 5-room at 47%. 3-room flats saw a strong 38% rise, while 2-room units grew about 20%.

Source: PropNex Investment Suite

This just goes to show that Queenstown remains one of the most resilient and in-demand mature estates.

Source: hdb.gov.sg

Average resale price (Nov 2024 - Oct 2025): $758,600

Average psf (Nov 2024 - Oct 2025): $814

The name "Bukit Merah," or "Red Hill" in Malay, came after red soil was uncovered during early excavations near Henderson and Lengkok Bahru. What was once a pepper and gambier plantation is now one of the most sought-after mature estates.

Sitting just outside the CBD, it covers five key areas: Tiong Bahru, Telok Blangah, Redhill, Mount Faber, and Tanjong Pagar. Each brings its own unique charm, from Tiong Bahru's pre-war flats to Tanjong Pagar's shophouses.

As of March 2025, Bukit Merah was home to about 124,950 HDB residents across 44,952 flats, making it one of the larger and more established estates in Singapore. And although the area has changed a lot over the years (just look at the caf culture and the weekend crowds!), it's never lost character and charm.

Plus, with the upcoming Greater Southern Waterfront set to transform the southern coastline into a new residential and commercial hub, Bukit Merah's appeal is only getting stronger.

You can see that reflected clearly in the numbers. Out of 947 resale transactions in the past year alone, a whopping 208 were million-dollar flats. It's no wonder Bukit Merah keeps making headlines for record-breaking sales (at least before Queenstown broke it earlier this year).

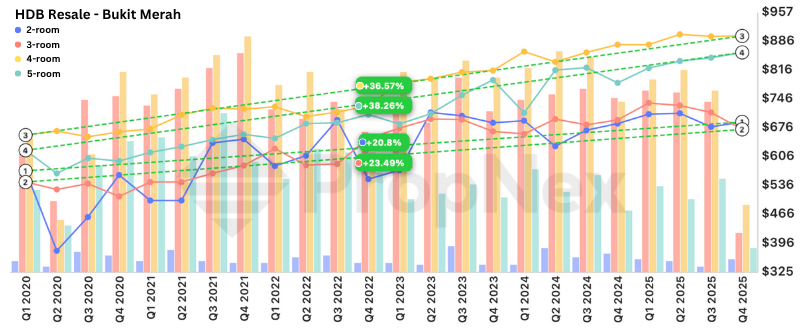

Since 2020, HDB resale prices here have climbed steadily across all flat types. 4- and 5-room flats are leading with 38% and 36% increase. However, 2- and 3-room units aren't far behind with a 23% and 21% growth.

Source: PropNex Investment Suite

Though the numbers aren't as dramatic as Central Area's and Queenstown's, it's worth remembering that Bukit Merah isn't nearly as scarce. Even so, demand here runs deep across all segments, which is a sign of how the estate continues to draw buyers who want city-fringe convenience without paying full-on city prices.

Source: hdb.gov.sg

Average resale price (Nov 2024 - Oct 2025): $932,870

Average psf (Nov 2024 - Oct 2025): $793

Bukit Timah is Singapore's tallest natural peak. There are different stories as to how it got its name. Some thought that Bukit Timah is Malay for 'tin-bearing hill'. Others believed Bukit Timah was a misinterpretation of 'Bukit Temak', which means 'hill of the temak trees'.

Only around 7,020 residents live here across 2,554 flats (as of 31 March 2025). That makes it one of the smallest public housing zones in Singapore, and the numbers reflect that scarcity today. Only 48 resale transactions took place in the past year, yet 18 of them crossed the million-dollar mark! A wild proportion for such a small town.

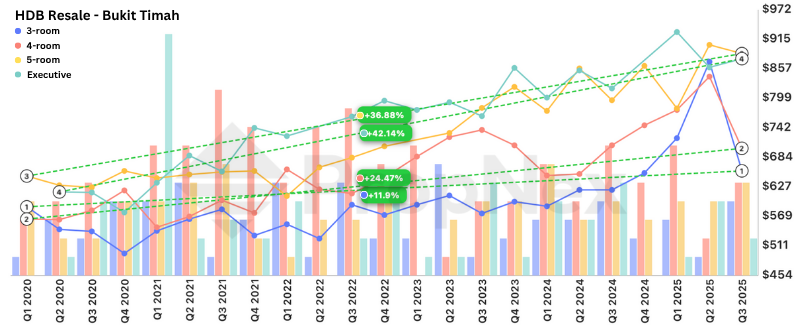

Price movements here show a clear upward trend. Since 2020, executive and 5-room flats have seen the strongest gains at around 42% and 37% respectively. 4-room units grew by 24% and 3-room units grew the slowest at just 12%. If not for the brief price dip earlier this year, 3- and 4-room units would've shown much more significant growths, and Bukit Timah would likely have ranked even higher on the list.

Source: PropNex Investment Suite

There were no 2-room resale transactions at all, which isn't surprising given how few exist in the first place. Buyers here tend to prioritise space and privacy, so the larger flat types naturally attract more interest. Besides, HDB living isn't the first thing people associate with Bukit Timah since this town is synonymous with luxury homes, prestigious schools, and nature reserves.

Regardless, this small estate is a very coveted one, which is why despite its tiny pool of resale transactions, it still managed to land in the top five most expensive towns this year.

Source: hdb.gov.sg

Average resale price (Nov 2024 - Oct 2025): $751,711

Average psf (Nov 2024 - Oct 2025): $788

Toa Payoh is another one of HDB's earliest towns, right after Queenstown actually. In Hokkien, Toa Payoh directly translates as 'big swamp', because the town used to be a large swampy area. As of March 2025, Toa Payoh is home to over 113,970 residents across 42,857 flats.

Fun fact: Toa Payoh is home to one of the very first MRT stations to open. So, centrality has always been one of its biggest draws. Located just minutes from Orchard Road and the CBD, this mature estate sits right in the middle of Singapore, offering residents the kind of everyday convenience that newer estates can't quite replicate.

Heritage is a huge part of its appeal too. From the iconic dragon playground to the old Town Garden (now Toa Payoh Town Park), these familiar landmarks give the neighbourhood a sense of warmth.

Source: Roots.gov.sg

Due to its location, connectivity, and character, Toa Payoh remains one of the most coveted and competitive towns. Out of 1,017 resale transactions in the past year, 300 crossed the million-dollar mark. That's almost one in three.

And like the other towns, resale prices have surged across all flat types. What's interesting, though, is that the smaller units actually saw the biggest jumps, with 2-room flats at 79% and 3-room at 78%. Following that are 4-rooms at 65%, 5-rooms at 54%, and executive flats at 47%.

Source: PropNex Investment Suite

It's a pretty interesting contrast against Queenstown, where executive flats saw the strongest growth. This could be because Queenstown has far fewer large units to begin with, so whenever one appears on the market, demand naturally spikes.

In Toa Payoh, though, the momentum seems to be coming from the smaller flats. This could be due to a mix of shifting demographics and evolving buyer behaviour. Perhaps more seniors are choosing to right-size here. Or maybe younger buyers are getting smaller homes to be in a more central location.

Regardless, it's a clear sign that there is strong demand here, and that the market stays resilient throughout the years.

You might be interested: Million-Dollar HDBS, Private Property Bubble? PropNex's Ismail Gafoor Shares His Take, $1 Million Resale HDB vs. $1 Million Condo, What Makes A District A Million-Dollar Magnet?

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.